Bertil Linter, who is probably the most prolific author when it comes to illicit DPRK/Myanmar relations, has published an interesting piece in the Asia Times on cargo shipping between the two countries. The whole piece is well worth reading.

The only comment I have on the article is in regards to his economic reasoning for why trade between the two countries makes sense:

All this seems to confirm what diplomatic observers have long suspected: that Myanmar and North Korea, two countries with limited access to bank and other international financial trade facilities, are engaged in barter trade. Myanmar’s ruling generals want more weapons but often don’t have the foreign funds handy to pay for them – or at least they don’t want such transactions to show up in their bank records. North Korea, meanwhile, is starved for food and likewise lacks the finances to pay for imports.

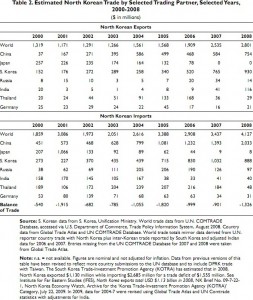

The DPRK does appear to be suffering a shortage of food, but the government does have the funds to pay for food imports–it just prefers to spend those funds in other ways. Below is a chart of the DPRK’s estimated trade balance from 2000-2008 published by the Congressional Research Service:

As you can see from the bottom line of the table, the DPRK has been running a substantial trade deficit (as a % of its total trade) for nearly the last decade. This trade deficit must be paid for with hard currency inflows of one kind or another (“aid”, investment, illicit exports). Where these funds are coming from and to whom specifically within the DPRK they are going is a mystery to me, but we do know they are importing (as a group) much more than they are exporting.

Below is the article in the Asia Times:

With the Middle East and North Africa in turmoil, North Korea risks losing some of its oldest and most trusted customers for military hardware. Pyongyang has over the years sold missiles and missile technology to Egypt, Libya, Yemen, the United Arab Emirates, Syria and Iran, representing an important source of export earnings for the reclusive regime. The growing uncertainty among those trade partners could explain why North Korea is now cementing ties with a client much closer to home: military-run Myanmar.

In April 2007, North Korea and Myanmar resumed diplomatic relations. Those ties were after North Korean agents planted a bomb in the then capital of Yangon in October 1983, killing 18 high-ranking South Korean officials who were on a visit to the country. Only days after the restoration of diplomatic ties, a North Korean freighter, the MV Kang Nam I, docked at Thilawa port, 30 kilometers south of Yangon.

Officials claimed at the time that the ship docked to seek shelter from a storm. However, two local reporters working for a Japanese news agency were turned back and briefly detained when they went to the port to investigate, indicating that there could have been other, more secret reasons for the Kang Nam I’s arrival.

The same ship was put on global radar in June 2009 when it was pursued by the USS John S McCain and then reversed course. It was believed that it was on its way back to Myanmar with more unspecified cargo. Military observers tied the Kang Nam 1 incidents to the arrival of another North Korean ship, MV Bong Hoafan, at a Myanmar port in November 2006 before the resumption of diplomatic relations. Curiously, it was also reported to have been “forced” to seek shelter at a Myanmar port because of “adverse weather conditions”.

An Asia Times Online investigation has found that those were not isolated incidents. Shipping records from Myanmar show that North Korean ships have been docking regularly at Thilawa and Yangon ports for almost a decade. Even the ill-fated Kang Nam 1 had docked in Myanmar long before the 2007 and 2009 incidents. The ship made its first voyage to Myanmar in February 2002, carrying what was declared as “general cargo,” according to the shipping records.

North Korean shipments are almost invariably specified as “general goods” and sometimes “concrete”, but both in and outgoing cargo is usually handled by Myanmar’s Ministry of Heavy Industry 2, which supervises the country’s defense industries, the armed forces’ Directorate of Procurement, and the military’s own holding company, the Union of Myanmar Economic Holdings (UMEH).

When the MV Bochon, another North Korean ship, arrived at Thilawa in October 2002, the Myanmar military’s high command sent a document marked “top secret” to the port authorities, requesting them to clear the entire docking area for “security reasons”. They were also advised, according to the shipping records, that some “important cargo” would be offloaded within 36 hours.

When the MV Chong Gen approached Thilawa on April 12, 2010, it asked for permission to fly a Myanmar flag instead of its North Korean one, according to the shipping records. The captain also requested a Myanmar SMC card (smart media card) for a mobile phone, along with coastal charts. These were odd requests for a ship that was officially carrying 2,900 tons of cement and 2,105 tons of “general goods” from the North Korean port of Nampo.

Bizzare barter

Indeed, the requests made by North Korean ships traveling to Myanmar have often been outright bizarre. MV Du Man Gang appears to be one of the most regular North Korean visitors at Thilawa. On one of its many trips to Myanmar, in July 2009 it asked for 150 crates of Myanmar brandy. In March 2010, when another North Korean ship, the MV Kan Baek San, arrived in Myanmar, the North Korean ambassador asked for an unspecified quantity of Myanmar vodka to be sent to the ship, according to the shipping records.The involvement of North Korean diplomats in these shipments is otherwise more convoluted. In September 2009, the MV Sam Il Po docked at a smaller terminal in Yangon and both the North Korean ambassador Kim Sok Chol and defense attach้ Kim Kwang Chol were present to inspect the cargo along with Lt Col Thein Toe from the Myanmar military. The unspecified cargo was received by UMEH, which in return supplied 1,500 tons of rice which was taken back to North Korea.

That was not the only incident when North Korean freighters returned with Myanmar rice. The MV So Hung arrived in November 2008 with 295 tons of material for the Ministry of Defense and left with 500 tons of rice. When the MV Du Man Gang docked in July 2009 it left with not only brandy but also 8,000 tons of rice. In June 2010, the MV An San arrived with 7,022 tons of what was alleged to be “concrete” and left in July with 7,000 tons of rice.

All this seems to confirm what diplomatic observers have long suspected: that Myanmar and North Korea, two countries with limited access to bank and other international financial trade facilities, are engaged in barter trade. Myanmar’s ruling generals want more weapons but often don’t have the foreign funds handy to pay for them – or at least they don’t want such transactions to show up in their bank records. North Korea, meanwhile, is starved for food and likewise lacks the finances to pay for imports.

When money is involved in North Korea-Myanmar trade, transactions are always done in cash and thus untraceable. Like all other ships, North Korean ones have to pay port fees in Myanmar. The MV Du Man Gang, for instance, asked to pay US$30,994 in cash rather than make a bank transfer. Other ships have made similar requests which has led to speculation about the kind of currency the North Koreans, notorious for counterfeiting US dollars, may be using.

Large quantities of counterfeit US notes have recently shown up in areas around Myanmar. In July and August 2009, a customer tried to change U$10,000 in fake notes at the State Bank of India’s main office in Imphal, Manipur. The fake bills were all of the US$100 denomination and of excellent quality, according to sources. It was the first such incident in Manipur. Although it is not clear whether the bogus notes were printed in North Korea, Imphal is located just over 100 kilometers from Moreh, an Indian town opposite Myanmar’s Tamu where a virtually unregulated border trade is booming.

Trade between North Korea and Myanmar is also apparently being done through front companies. In June 2010, the North Korean freighter MV Ryu Gong arrived with 12,838 tons of what was also described as “cement”. While the shipment was handled by the Ministry of Heavy Industry 2, the stated recipient was a little-known company known as Shwe Me, or “black gold” in Myanmar.

Port documents show that the company has nearly a million US dollars in assets but what it actually intended to do with all that cement is unclear. Just as puzzling is the involvement of Singapore-based shipping companies, which handle most of the cargo’s logistics and operate under innocuous sounding names including words like “maritime” and “services”. One of the companies has a distinct Korean name but is actually based in Singapore.

Port records point to a brisk trade between North Korea and Myanmar, all of which is handled by Myanmar’s military rather than civilian-owned private companies. In August last year, then prime minister and now president Thein Sein visited Pyongyang. According to the official Korea Central News Agency, he said that “the government of Myanmar will continue to strive for strengthening and development of the friendly and cooperative relations between the two countries.”

With those intentions publicly well-stated, Myanmar may well be on its way in overtaking Egypt, Libya and other traditional military trading partners in the Middle East and North Africa as North Korea’s main market for its military hardware.

Read the full story here:

Fog lifts on Myanmar-North Korea barter

Asia Times

Bertil Linter

3/4/2011