By: Benjamin Katzeff Silberstein

Early this morning local time, North Korean leader Kim Jong Un arrived in the Russian town of Vladivostok. There, he is scheduled to meet with Russian president Vladimir Putin. Aside from the geopolitical situation and their political ties, the two are expected to discuss expanding North Korean weapons exports to Russia.

What could this mean for the North Korean economy?

The country’s military industry is an economic sector of significant size both in terms of production and employment. A radical increase in weapons exports to Russia could mean a general boost for the economy through increased consumption.

Gains will, however, be limited by the military industry’s isolated position in the economic structure. Many of the military’s factories supply themselves with most essential raw materials through mines and energy supply channels of their own. While many other sectors in the economy have essentially been privatized since the mid-1990s, the arms industry is entirely controlled and centrally planned by the state. Weapons exports to Russia could in fact hamper North Korea’s economic development in the long run by diminishing the regime’s incentives to reform the domestic economy.

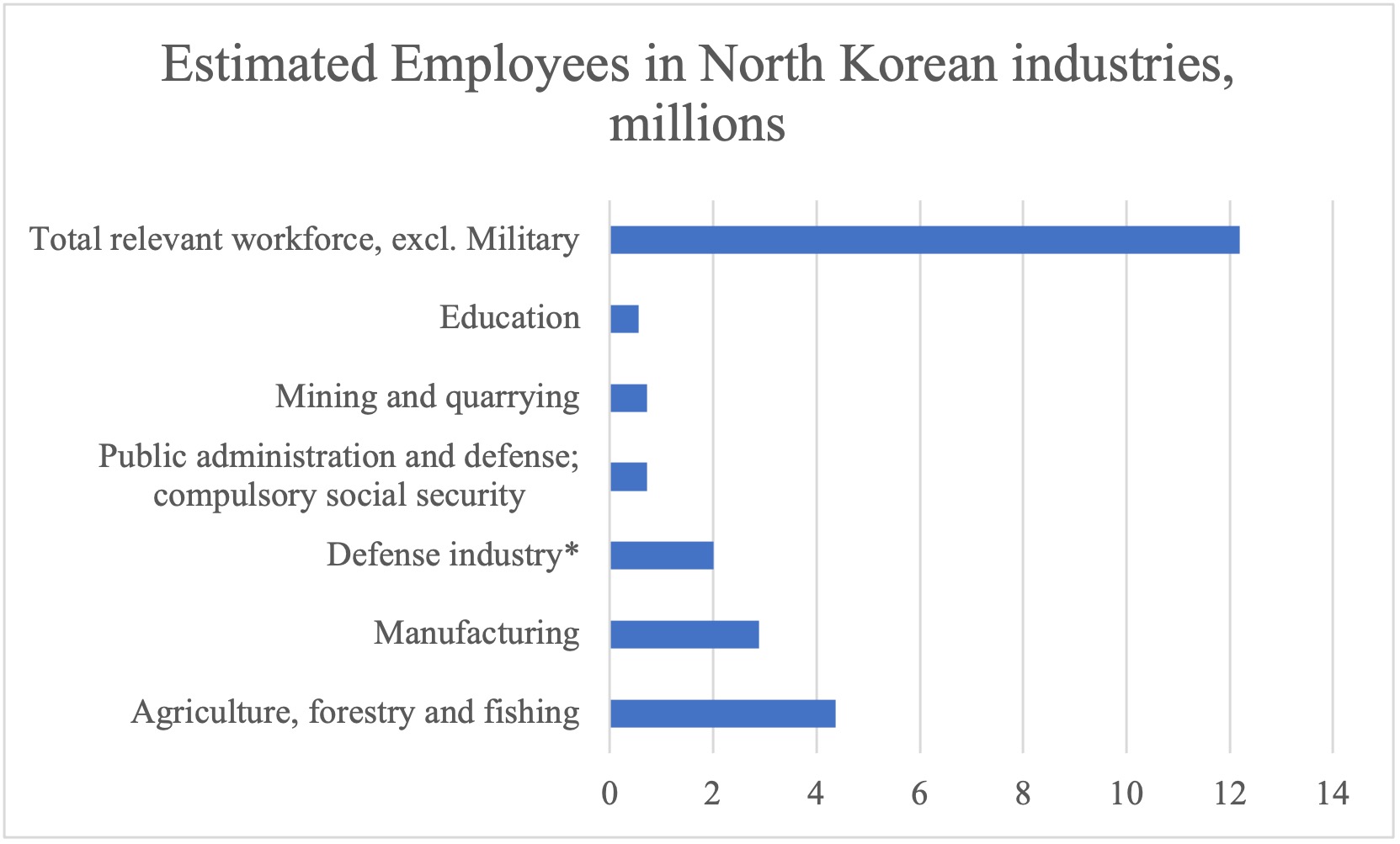

Although the sector is far from the country’s top employer, with two million estimated workers in the defense industry, its contribution to the economy is significant. For a sense of proportion, North Korea’s 2008 census lists 4.4 million as workers in agriculture (including forestry and fishing), 718,000 in mining and quarrying, and close to 3 million in manufacturing. A massive and sudden expansion in weapons exports would not drastically change North Korea’s economic situation but could nonetheless make a modest contribution to economic growth and consumption.

Data sources: DPRK 2008 Census, Namhoon Cho (2019)* (see p. 576 for figures.)

As graph 1 shows, the country’s defense industry is estimated to be the third largest employer in the country. Because the data is so unreliable, these figures should not be taken at face-value. Rather, the proportions are what matter. Regardless of their exact number compared with other groups in the workforce, at an estimated two million, their employees are numerous enough for a drastic increase in purchase orders from Russia to boost the economy through increased wages, expanded hiring, or a combination of both. Major and continuous orders from Russia would benefit some parts of the military industry more than others.

Most profits will likely go directly to the state and the military, but workers in the industry may see their pay rise, and new colleagues recruited, if the orders from Russia end up being large enough. All this will have ripple effects on the overall economy, with increased consumption stimulating the consumer goods economy and service sector as well. Economic benefits are likely to be highly regional, with the impoverished Jagang province standing out as a central beneficiary thanks to its high concentration of arms factories.

In the long run, however, North Korea’s economic benefits will likely be limited. The military economy is independent from the “people’s economy” and is usually known as “the second economy.” The military often operates its own factories and mines through a military-industrial complex of sorts, and do not need to turn to other sectors of the economy for raw materials and other inputs. All this is by design, to give the military special status in funding and budget priorities. This limits the potential spillover effects into other industries.

Overall, boosted arms industry exports could diminish the regime’s incentives to develop the market system. The North Korean leadership is currently on a campaign to restore (at least some of) the state’s power over the economic system, including the private and semi-private sectors such as the general market and service sectors. An inflow of cash or other compensation from Russia, such as vast amounts of fuel oil and food, could give the regime more space and safety to suppress private economic activity in favor of the state-controlled sector. This fits well with the regime’s current strategy for the economy but will dampen the country’s long-term prospects for economic development.