These are all interesting data points. Do you think they offer reasonable journalistic evidence that the DPRK is practicing inflationary public finance?

First, Yonhap reports on DPRK food imports from China (2012-9-29):

North Korea’s grain imports from China slipped 16.3 percent on year in the first eight months of this year, in an apparent sign that the North may diversify its supply channels of grain, a Seoul researcher said Saturday.

North Korea imported 181,264 tons of rice, flour, corn and other grains from China in the eight-month period, compared with 216,535 tons for the same period last year, said Kwon Tae-jin of the state-run Korea Rural Economic Institute.

The decline in grain imports from China may be attributed to a rise in food aid from China and purchases from non-China markets such as Europe and South America, Kwon said.

“Including imports from non-China markets, North Korea’s total grain imports appeared to rise this year,” Kwon said in a report posted on his Web site, adding Pyongyang may “diversify its import channels.”

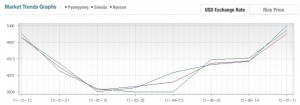

At the same time the Daily NK reports that food prices continue to rise (2012-10-2):

Internal sources informed Daily NK over the holiday that on September 29th the price of rice was 6,700 won/kg in Pyongyang, 7,000 won/kg in Onsung, North Hamkyung Province and 6,500 won/kg further west in Hyesan, Yangkang Province.

Not only do these prices far exceed those of Chuseok 2011, they even far exceed those of earlier this year.

The Hyesan source explained that on the day before the Chuseok holiday (Saturday) the atmosphere in the market was thus rather uncomfortable. “It was very slack,” she said. “People couldn’t buy anything easily, so most just seemed to be looking.”

Secondly, Yonhap reports that despite situations like those experienced by Xiyang or in Musan, mineral exports to China are up (2012-10-2):

North Korea’s exports of mineral resources recorded a 33-fold jump over the past decade with China remaining the biggest importer of the North’s iron ore and coal, a report showed Tuesday.

North Korea’s mineral exports stood at a meager US$50 million in 2001, accounting for 7.8 percent of its total exports, according to the report by Seoul’s Korea Trade and Investment Promotion Agency.

The mineral exports soared to $243 million in 2005 and $1.65 billion in 2011, accounting for 59.4 percent of the North’s total exports last year, the report said.

South Korea has estimated the total values of mineral deposits in North Korea at some $6.3 trillion.

Last year, North Korea exported $1.17 billion worth of anthracite coal and $405 million worth of iron ore, with China importing almost 100 percent of anthracite coal and iron ore, it said.