Archive for the ‘Fiscal & monetary policy’ Category

Wednesday, March 11th, 2009

North Korea Uncovered v.16

Download it here

The most recent version of North Korea Uncovered (North Korea Google Earth) has been published. Since being launched, this project has been continuously expanded and to date has been downloaded over 32,000 times.

Pictured to the left is a statue of Laurent Kabila of the Democratic Republic of Congo. This statue, as well as many others identified in this version of the project, was built by the North Koreans. According to a visitor:

From the neck down, the Kabila monument looks strangely like Kim Jong Il: baggy uniform, creased pants, the raised arm, a little book in his left hand. From the neck up, the statue is the thick, grim bald mug of Laurent Kabila (his son Joseph is the current president). “The body was made in North Korea,” explains my driver Felix. In other words, the body is Kim Jong Il’s, but with a fat, scowling Kabila head simply welded on.

This is particularly interesting because there are no known pictures of a Kim Jong il statue. The only KJI statue that is reported to exist is in front of the National Security Agency in Pyongyang. If a Kim Jong il statue does in fact exist, it might look something like this.

Thanks again to the anonymous contributors, readers, and fans of this project for your helpful advice and location information. This project would not be successful without your contributions.

Version 16 contains the following additions: Rakwon Machine Complex, Sinuiju Cosmetics Factory, Manpo Restaurant, Worker’s Party No. 3 Building (including Central Committee and Guidance Dept.), Pukchang Aluminum Factory, Pusan-ri Aluminum Factory, Pukchung Machine Complex, Mirim Block Factory, Pyongyang General Textile Factory, Chonnae Cement Factory, Pyongsu Rx Joint Venture, Tongbong Cooperative Farm, Chusang Cooperative Farm, Hoeryong Essential Foodstuff Factory, Kim Ki-song Hoeryong First Middle School , Mirim War University, electricity grid expansion, Tonghae Satellite Launching Ground (TSLG)” is also known as the “Musudan-ri Launching Station,” rebuilt electricity grid, Kumchang-ri suspected underground nuclear site, Wangjaesan Grand Monument, Phothae Revolutionary Site, Naedong Revolutionary Site, Kunja Revolutionary Site, Junggang Revolutionary Site, Phophyong Revolutionary Site, Samdung Revolutionary Site, Phyongsan Granite Mine, Songjin Iron and Steel Complex (Kimchaek), Swedish, German and British embassy building, Taehongdan Potato Processing Factory, Pyongyang Muyseum of Film and Theatrical Arts, Overseas Monuments built by DPRK: Rice Museum (Muzium Padi) in Malaysia, Statue de Patrice Lumumba (Kinshasa, DR Congo), National Heroes Acre (Windhoek, Namibia), Derg Monument (Addis Ababa, Ethiopia), National Heroes Acre (Harare, Zimbabwe), New State House (Windhoek, Namibia), Three Dikgosi (Chiefs) Monument (Gaborone, Botswana), 1st of May Square Statue of Agostinho Neto (Luanda, Angola), Momunment Heroinas Angolas (Luanda, Angola), Monument to the Martyrs of Kifangondo Battle (Luanda, Angola), Place de l’étoile rouge, (Porto Novo, Benin), Statue of King Béhanzin (Abomey, Benin), Monument to the African Renaissance (Dakar, Senegal), Monument to Laurent Kabila [pictured above] (Kinshasa, DR Congo).

Posted in Agriculture, Architecture, Art, Automobiles, Aviation, Banking, Coal, Communications, Computing/IT, Construction, Dams/hydro, Education, Electricity, Energy, Environmental protection, Figure skating, Film, Finance, Fiscal & monetary policy, Food, Football (soccer), Forestry, Gambling, Gasoline, General markets (FMR: Farmers Market), Golf, Google Earth, Health care, Hoteling, Hwanggumphyong and Wihwado Economic Zones (Sinuiju), Intranet, Kaesong Industrial Complex (KIC), Leisure, Library, Light Industry, Mansudae Overseas Development Group, Manufacturing, Mass games, Military, Mining/Minerals, Mt. Kumgang Tourist Special Zone, Music, Nuclear, Oil, Pyongyang Metro, Railways, Rason Economic and Trade Zone (Rajin-Sonbong), Real estate, Religion, Restaurants, Sea shipping, Special Economic Zones (Established before 2013), Sports, Telephones, Television, Tourism, Transportation, Water, Wind | 10 Comments »

Sunday, March 1st, 2009

The global financial crisis/recession is affecting some of the DPRK’s most visible assets.

The first example comes from the Kaesong Industrial Zone, where South Korean firms are obliged to pay North Korean workers’ wages in $US directly to the North Korean government. Since the South Korean Won/$US exchange rate has risen significantly in recent months, companies in the Zone have seen their labor costs (denominated in $US) soar. Since wages are fixed and firms are unable to lay off workers, some have responded by simply not paying wages—which does not affect the workers so much as it does the North Korean government’s finances, since it keeps most of the funds.

Quoting from Radio Free Asia:

Authorities in North Korea have warned South Korean companies in its Kaesong industrial area they must pay workers’ wages or face fines, as many investors begin to feel the effects of the economic downturn.

Lee Lim-dong, secretary general of the Committee of the Association of Enterprises Invested in the Kaesong Industrial Complex, said the issue of unpaid salaries was brought up late last year but had now become a formal demand.

“This time around, official notification was issued to all South Korean enterprises invested in Kaesong, through the Kaesong Industrial District Management Committee (KIDMC),” Lee said.

South Korean businesses invested in Kaesong have already incurred serious losses due to the depreciation of the South Korean won against the U.S. dollar, according to Kim Kyu Chol, head of the Forum for Inter-Korean Relations, a Seoul-based group monitoring inter-Korean business relations.

“They already have to spend 30-45 percent more on labor [because of this],” he said, adding that the lives of South Korean entrepreneurs in the Kaesong economic zone would now be even more difficult.

…

According to Park Yong-man, director of Green Textile Co.—a South Korean company invested in Kaesong—“The official notification was sent to all South Korean companies in Kaesong on Feb. 10.”

Meanwhile, Kim said, one South Korean electroplating company had already failed to pay its North Korean workers for more than three months and had been suspended.

Seven South Korean companies in Kaesong are currently unable to pay their North Korean workers on time and will soon be in bigger trouble because of the new measures, Kim said.

South Korean companies operating in Kaesong are not allowed to recruit or dismiss North Korean staff directly, and North Korean authorities impose quotas of staffing numbers on them.

In early February, North Korean officials said that salaries of North Korean supervisors watching over the night shift at South Korean enterprises in Kaesong would have to increase by 200-300 percent, putting further pressure on labor costs.

And companies can be suspended from operations for failing to pay their employees for more than a month.

Kim said South Korean companies in Kaesong don’t need more supervisors or clerical workers, which the North Korean side has sought.

“They are already facing a managerial crisis, and a [demanded] 50 percent increase in the number of North Korean managerial staff is pushing it too hard,” he said, adding that South Korean enterprises would find this hard to accept.

Until recently, the Kaesong Industrial District Management Committee (KIDMC), a joint North-South panel overseeing the complex, was responsible for half of the U.S. $10 a month transportation allowance given to North Korean workers in Kaesong.

North Korea demanded as of Jan. 1 that South Korea Kaesong companies must now pay the entire cost.

Now hard bargaining can pay off sometimes, especially for North Korea, but with all that has happened in the Zone recently it seems as if the DPRK actually wants these businesses to leave. The DPRK’s negotiators are smart enough to know that the pie is shrinking and they naturally want to protect their share, but unfortunately they don’t yet seem to appreciate that their actions will have serious ramifications on future investment in the Zone once the global economy turns the corner.

Example No. 2: Unfortunately, recent economic conditions have also reduced the number of South Korean tourists venturing abroad where they might enjoy diversions such as eating in a North Korean-owned restaurant.

Quoting from Japan Probe:

Ever since a North Korean government restaurant opened in Bangkok two years ago, the Japanese press have been regularly visiting the place with hidden cameras to catch a glimpse of its dinnertime performances. However, it has now been discovered that the restaurant recently went out of business.

Most of its business had come from South Korean tourists, but the weakening of the won and the decline in tourism to Thailand due to the airport protests seem to have dealt a death blow to the restaurant. Attempts to contact North Korea-run restaurants in Cambodia and Vietnam failed, suggesting that those restaurants may have also gone under. It has also been said that a similar North Korean restaurant in China has suffered a big drop in business.

Read the RFA article here:

North Korea Warning Over Labor

Radio Free Asia

J.W. Noh

9/26/2009

Posted in Fiscal & monetary policy, Kaesong Industrial Complex (KIC), Labor conditions/wages, Manufacturing, Restaurants, Special Economic Zones (Established before 2013), Thailand | 1 Comment »

Saturday, February 7th, 2009

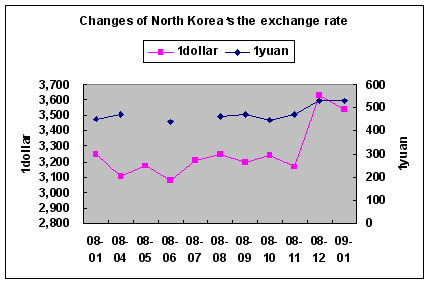

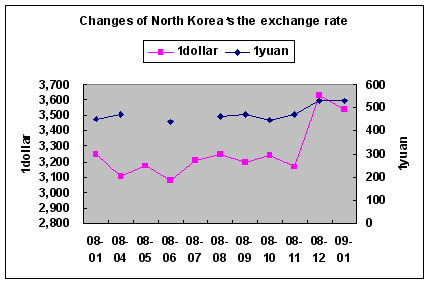

(Hat tip to One Free Korea)—According to Open Radio for North Korea, the DPRK won experienced a significant devaluation against to the dollar in the latter half of 2008:

According to the table and the article:

In 2008, North Korea’s exchange rate has shown relative stability of 3200 Won per Dollar and 460 Won per Chinese Yuan.

However, in December 2008, the exchange rate started to skyrocket. The exchange rate in December was 3630 won per Dollar and 530 Won per Chinese Yuan- which was approximately 13 to 15 percent increase from the month before. The exchange rate fell slightly to 3540 Won per Dollar and 530 Won per Yuan in January. Nonetheless, the exchange rate isn’t likely to decrease further.

The sudden rise in foreign currency exchange rate in December seems to have correlation with the Chinese restriction on North Korean imports. According to Chinese and North Korean traders, the sub par quality of imported products from China (speculated to be food products with melamine) was the origin of the Chinese restriction. Sporadic breakout of illnesses in various regions of North Korea caused general distrust over Chinese imports, and the North Korean government relayed the complaints to Chinese authorities. China in turn took a chauvinistic approach and unilaterally regulated trade between China and North Korea to teach North Korea a “lesson”

Nearly 50% of North Korean trade is with China. Therefore, regulation on trade between North Korea and China, especially on North Korean exports to China inevitably has a severe impact on foreign currency market in North Korea.

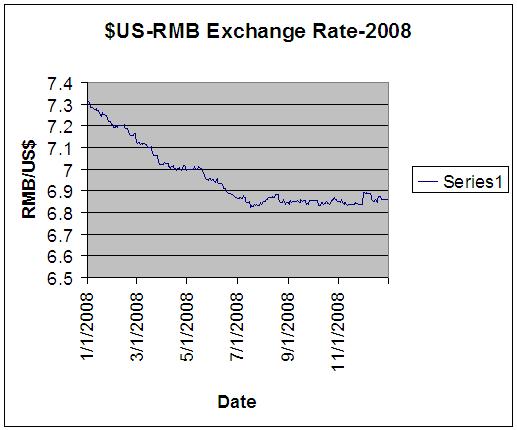

For comparison I put together a table of the US$-RMB exchange rate during 2008 (interbank spot rate) using FX history:

So now we can conclude that in 2008 the Yuan appreciated against both the DPRK won and the and the US dollar, and that the US dollar appreciated against the DPRK won.

So the next question is: how efficient are the currency markets which trade DPRK won? Doing some back of the napkin calculations using data from these two different sources (the story and FX History), I seem to have reached the conclusion that the DPRK won is traded rather efficiently.

The average RMB/USD exchange rate (interbank spot) in December 2008 was 6.86 RMB/USD (from FX history). If you converted 686 RMB into USD, you would receive $100. If you converted US$100 into DPRK won at the 3,630 rate in the story quoted above, you would receive w 363,000. If you exchanged those won for Chinese RMB at the 530 rate quoted in the story, you would receive 684.90 RMB. 684.90 is 99.83% of 686.

That seems too good to be true.

Posted in Banking, Fiscal & monetary policy | Comments Closed

Thursday, February 5th, 2009

The purpose of these types of indexes is to put pressure on world governments to improve their economic policies. Unfortunately, the DPRK has come in last place for as long as I have been paying attention….

From the 2009 Index of Economic Freedom:

North Korea’s economic freedom score is 2, making its economy the least free in the 2009 Index. North Korea is ranked 41st out of 41 countries in the Asia-Pacific region.

North Korea does not score well in any single area of economic freedom, although it does score some minimal points in investment freedom and property rights. The Communist Party controls and commands almost every aspect of economic activity. Since the early 1990s, North Korea has replaced the doctrine of Marxism’Leninism with the late Kim Il-Sung’s juche (self-reliance) as the official state ideology. Yet the country’s impoverished population is heavily dependent on government subsidies in housing and food rations even though the state-run rationing system has deteriorated significantly in recent years.

North Korea devotes a disproportionately large share of GDP to military spending, further exacerbating the country’s already poor economic situation. Normal foreign trade is minimal, with China and South Korea being the most important trading partners. Trade with India is increasing. No courts are independent of political interference, and private property (particularly land) is strictly regulated by the state. Corruption is rampant but hard to distinguish from regular economic activity in a system in which arbitrary government control is the norm.

The Democratic People’s Republic of Korea is one of the world’s most oppressed and closed societies, and its Communist rulers have repressed basic human rights and nationalized all industry since the country’s founding in 1948. In the 1990s, floods and droughts exacerbated systemic shortcomings and led to severe famine and millions of civilian deaths. North Korea’s economy is mainly supported by international aid and trade with its major trading partners, China and South Korea.

Business Freedom

0.0

The overall freedom to start, operate, and close a business is extremely restricted by North Korea’s national regulatory environment. The state regulates the economy heavily through central planning. Economic reforms implemented in 2002 allegedly brought some changes at the enterprise and industrial levels, but entrepreneurial activity is virtually impossible.

Trade Freedom

0.0

The government controls all imports and exports, and formal trade is minimal. North Korean trade statistics are limited and compiled from trading partners’ data. Most trade is de facto aid, mainly from North Korea’s two main trading partners, China and South Korea. Non-tariff barriers are significant. Inter-Korean trade remains constrained by North Korea’s unwillingness to implement needed reform. Given the minimal level of trade, a score of zero was assigned.

Fiscal Freedom

0.0

No data on income or corporate tax rates are available because no effective tax system is in place. The government plans and manages almost every part of the economy. Given the absence of published official macroeconomic data, such figures as are available with respect to North Korea’s government expenditures are suspect and outdated.

Government Size

0.0

The government owns virtually all property and sets production levels for most products, and state-owned industries account for nearly all GDP. The state directs all significant economic activity. Large military spending further drains scarce resources.

Monetary Freedom

0.0

Price and wage reforms introduced in July 2002 consisted of reducing government subsidies and telling producers to charge prices that more closely reflect costs. Without matching supply-side measures to boost output, the result has been rampant inflation for many staple goods. Because of the ongoing crisis in agriculture, the government has banned sales of grain at markets and returned to rationing. A score of zero was assigned.

Investment Freedom

10.0

North Korea generally does not welcome foreign investment. A small number of projects may be approved by top levels of government; however, the scale of these investments is also small. Numerous countries employ sanctions against North Korea, and ongoing political and security concerns make investment extremely hazardous. Internal laws do not allow for international dispute arbitration. One attempt to open the economy to foreigners was North Korea’s first special economic zone, located at the remote Rajin-Sonbong site in the Northeast. Wage rates in the special zone are unrealistically high because the state controls the labor supply and insists on taking a share of wages. More recent special zones at Mt. Kumgang and Kaesong are more enticing. Aside from these few economic zones where investment is approved on a case-by-case basis, foreign investment is prohibited.

Financial Freedom

0.0

North Korea is a command-and-control economy with virtually no functioning financial sector. Access to financing is very limited and constrained by the country’s failed economy. The central bank also serves as a commercial bank and had more than 200 local branches in 2007. The government provides most funding for industries and takes a percentage from enterprises. Foreign aid agencies have set up microcredit schemes to lend to farmers and small businesses. A rumored overhaul of the financial system to permit firms to borrow from banks instead of receiving state-directed capital has not materialized. Because of debts dating back to the 1970s, most foreign banks will not enter North Korea.

Property Rights

5.0

Property rights are not guaranteed. Almost all property, including nearly all real property, belongs to the state, and the judiciary is not independent. The government even controls all chattel property (domestically produced goods as well as all imports and exports).

Freedom From Corruption

5.0

After the mid-1990s economic collapse and subsequent famines, North Korea developed an immense informal market, especially in agricultural goods. Informal trading with China in currency and goods is active. There are many indicators of corruption in the government and security forces. Military and government officials reportedly divert food aid from international donors and demand bribes before distributing it.

Labor Freedom

0.0

As the main source of employment, the state determines wages. Since the 2002 economic reforms, factory managers have had limited autonomy to set wages and offer incentives, but highly restrictive government regulations hinder any employment and productivity growth.

Posted in Fiscal & monetary policy, Foreign direct investment, International trade, Labor conditions/wages, Private property | Comments Closed

Saturday, January 24th, 2009

Writing in the Daily NK, guest author “Benji” and an astute reader offer us this little glimpse of economic rationality in North Korean culture.

Commenting on the photo above, “Benji” notes:

“A North Korean soldier in front of an amazing view from [Mt. Pektu]. Minutes later, he was to offer me one of his cigarettes.”

An astute reader made the following comment:

“The cigarette from the Soldier probably wasn’t the kind offer it seemed to be. North Koreans use cigarettes as currency. When they see a western tourist they offer their substandard north korean cigarettes in the hope of receiving western thus more valuable ones in exchange, or if they are especially lucky chinese Double Hapiness“

The pictures and story are worth reading here:

Sacred and Stunning Mountain, Baekdu

Daily NK

“Benji”

1/22/2009

Posted in Fiscal & monetary policy, Special Economic Zones (Established before 2013), Tobacco, Tourism, Uncategorized | Comments Closed

Thursday, January 15th, 2009

Institute for Far Eastern Studies (IFES)

NK Brief No. 09-1-15-1

2009-01-15

The exchange rate for the North Korean won shot up approximately 13-15 percent at the end of last year, and has maintained this high rate into January, according to an article in the on-line newsletter, “Open News for North Korea,” on January 12.

According to the inaugural edition of the newsletter, the exchange rate last year was around 3,200 won per USD, or 460 won per Yuan, with only slight fluctuations, but shot up to 3,630 won per USD and 530 won per Yuan in December. In the first weeks of the new year, it has fallen only slightly, to 3,540 won per USD, and 530 won per Yuan.

According to traders who import and export between North Korea and China, “The sudden rise in the exchange rate appears to be related to trade regulations on goods imported from the North,” and they stressed, “After North Korea protested to China about inferior Chinese goods leading to accidents around the country, China decided to set an example, and unilaterally imposed [trade] restrictions.”

Because business with China makes up almost 50 percent of North Korea’s trade, if DPRK-PRC trade, and in particular, North Korea’s exports to China, are restricted, this would cause a large shock to the foreign currency market,” and, “China’s regulatory measures were eased as January come around,” but, “this year, North Korea is strengthening crackdowns on domestic markets, making it difficult to expect the exchange rate to return” to last year’s lower numbers. According to the article, “There is a foreign currency crisis in North Korea, as well, the scale of which is so great it can’t even be compared to what is happening in the South.”

The black market price for U.S. dollars has shot up from a low of 200 won, in July 2002, to 3,200 won in July of last year, and has continued to rise, peaking at 3.500 won currently. This is a sixteen-fold increase in just over six years. The newsletter put this in perspective by explaining, “North Korea has experienced a foreign currency crisis like that seen in South Korea in 1998 every year since 2002.”

North Korea’s haphazard currency distribution and chronic trade deficit has led to a reduction in the country’s foreign currency reserves, while the failure of the authorities’ currency stabilization policies combined with the growing demand for U.S. dollars by North Korean residents seeking imported goods have led to the sharp growth in the exchange rate.

Posted in Banking, China, Finance, Fiscal & monetary policy, Institute for Far Eastern Studies, International trade, Trade Statistics | Comments Closed

Tuesday, October 7th, 2008

According to Yonhap:

North Korea owes a total of $18 billion to 30 different countries, including Russia and China, said Kwon Young-se of the ruling Grand National Party (GNP), citing estimates from the Unification Ministry.

The amount is almost equal to North Korea’s gross domestic product (GDP) for last year, which totaled 24.7 trillion won ($18.4 billion).

South Korea has loaned roughly 1.19 trillion won to the North, equivalent to nearly five percent of Pyongyang ‘s total foreign debt.

…

“North Korea’s foreign debt is the result of the accumulation of unpaid trade bills and loans that it received from socialist states in the 1950s and 60s and from the Western world in the 70s to develop its economy,” Kwon said.

“The volume of foreign debt is expected to continue to rise due to the interest added to unpaid debts, although that can fluctuate depending on the result of negotiations with foreign creditors,” he added. (Yonhap)

According to the CIA world factbook, however, North Korea’s total external debt was estimated at $12.5 billion in 2001. If I put aside the fact that the South Korean Ministry of Unification and the US CIA are probably reporting dollar figures using different basis years, North Korea’s external debt has increased increased nearly 47% in the last seven years. I do not think this drastic increase could be attributed to the accumulation of interest arrears dating back to the 1950s.

Posted in Banking, Debt, Finance, Fiscal & monetary policy, Statistics, Trade Statistics | Comments Closed

Thursday, October 2nd, 2008

North Korea Uncovered: Version 12

Download it here

About this Project: This map covers North Korea’s agriculture, aviation, cultural locations, markets, manufacturing facilities, energy infrastructure, political facilities, sports venues, military establishments, religious facilities, leisure destinations, national parks, shipping, mining, and railway infrastructure. It is continually expanding and undergoing revisions. This is the 12th version.

About this Project: This map covers North Korea’s agriculture, aviation, cultural locations, markets, manufacturing facilities, energy infrastructure, political facilities, sports venues, military establishments, religious facilities, leisure destinations, national parks, shipping, mining, and railway infrastructure. It is continually expanding and undergoing revisions. This is the 12th version.

Additions include: Tongch’ang-dong launch facility overlay (thanks to Mr. Bermudez), Yongbyon overlay with destroyed cooling tower (thanks to Jung Min Noh), “The Barn” (where the Pueblo crew were kept), Kim Chaek Taehung Fishing Enterprise, Hamhung University of education, Haeju Zoo, Pyongyang: Kim il Sung Institute of Politics, Polish Embassy, Munsu Diplomatic Store, Munsu Gas Station, Munsu Friendship Restaurant, Mongolian Embassy, Nigerian Embassy, UN World Food Program Building, CONCERN House, Czech Republic Embassy, Rungnang Cinema, Pyongyang University of Science and Technology, Pyongyang Number 3 Hospital, Electric Machines Facotry, Bonghuajinlyoso, Second National Academy of Sciences, Central Committee Building, Party Administration Building, Central Statistics Bureau, Willow Capital Food House, Thongounjong Pleasure Ground, Onpho spa, Phipa Resort Hotel, Sunoni Chemical Complex (east coast refinery), Ponghwa Chemical complex (west coast refinery), Songbon Port Revolutionary Monument, Hoeryong People’s Library, Pyongyang Monument to the anti Japanese martyrs, tideland reclamation project on Taegye Island. Additionally the electricity grid was expanded and the thermal power plants have been better organized. Additional thanks to Ryan for his pointers.

I hope this map will increase interest in North Korea. There is still plenty more to learn, and I look forward to receiving your contributions to this project.

Version 12 available: Download it here

Posted in Agriculture, Animation, Architecture, Art, Automobiles, Aviation, Banking, Cell phones, Coal, Communications, Computing/IT, Construction, Copper, Dams/hydro, Education, Electricity, Energy, Environmental protection, Film, Finance, Fiscal & monetary policy, Food, Football (soccer), Foreign direct investment, Forestry, Gambling, Gasoline, General markets (FMR: Farmers Market), Gold, Golf, Google Earth, Health care, Hoteling, Hwanggumphyong and Wihwado Economic Zones (Sinuiju), International trade, Joint Ventures, Kaesong Industrial Complex (KIC), Leisure, Library, Light Industry, Lumber, Manufacturing, Mass games, Military, Mining/Minerals, Mt. Kumgang Tourist Special Zone, Music, Nuclear, Pyongyang Metro, Railways, Rason Economic and Trade Zone (Rajin-Sonbong), Real estate, Religion, Restaurants, Sea shipping, Special Economic Zones (Established before 2013), Sports, Television, Tourism, Transportation, Wind | 1 Comment »

Tuesday, September 30th, 2008

The DPRK’s recent efforts to reconstruct the Yongbyon 5MW nuclear reactor seem to have brought implementation of the “second” Agreed Framework to a halt, though it was already behind schedule. This week the US sent Chris Hill to Pyongyang to try and rescue the process which is hung up on verification protocol. The North claims to have sufficiently declared their nuclear capabilities and believe they should be removed from the US list of state sponsors of terror. The US does not believe this condition has been met and seeks to establish a protocol to verify if the North’s declaration is accurate.

Japan is also set to extend sanctions (due to expire) on the DPRK. According to Bloomberg:

Japan’s ruling Liberal Democratic Party decided to extend sanctions against North Korea for six months after their Oct. 13 expiration date, Jiji Press reported.

LDP lawmakers agreed to extend the sanctions because North Korea took steps to reactivate its nuclear program and made little progress in an investigation into Japanese nationals abducted by North Korean agents, Jiji reported.

Prime Minister Taro Aso’s Cabinet is likely to endorse the extension by Oct. 10., the Japanese wire service said.

The sanctions include a ban on North Korean imports and the entry of North Korean ships into Japanese ports. The extension will be the fourth since sanctions began after North Korea’s October 2006 nuclear test, Jiji said.

Just as the DPRKs hopes of restoring/establishing relations with Japan and the US start to dim, however, they have reached out to South Korea, with whom political relations had recently gone sour due to the South’s policy change from unsupervised aid provision under the “sunshine policy” to a quid-pro-quo relationship under a “policy of mutual benefits and common prosperity“. Additionally, the fatal shooting of a South Korean tourist in Kumgangsan led to a deterioration in cooperation between the two governments and suspension of the inter-Korean project (a cash cow for the North).

How much was the Sunshine Policy worth to the North? South Korean GNP lawmaker Jin Yeong, who analzed data submitted by the Unification Ministry and the Export-Import Bank of Korea, claims that the Kim and Roh administrations oversaw the transfer of 8.38 trillion South Korean Won in aid and loans since 1998.

Taking office in February 2003 after the second North Korean nuclear crisis emerged in September 2002, Roh doled out 5.68 trillion won to Pyongyang over his five-year term, double that of his predecessor Kim (2.70 trillion won).

Kim and Roh gave to North Korea 2.4 trillion won for building light-water reactors and in food aid; 2.5 trillion won to pin the price of rice aid to that of the global market; 2.8 trillion won for other aid including fertilizer; and 696 billion won in aid from advocacy groups and provincial governments.

In 2003, South Korean aid to the North reached a high of 1.56 trillion won. Then after North Korean leader Kim Jong Il declared that his country had gone nuclear in 2005, the Roh administration sent 1.48 trillion won to the North.

Jin said, “South Korea gave a loan with rice first in 2000. Payments on the loan are deferred for 10 years. Thus, we are to receive the first repayment installment in 2010. But most of the 2.4 trillion won in loans seem irrecoverable.”

PricewaterhouseCoopers Korea audited the fiscal 2007 accounts of Seoul`s inter-Korean cooperation funds, saying, “Considering the characteristics of the North Korean government, grave uncertainty exists over the possibility of redeeming the loans given to the regime. The ultimate outcome depends heavily on the conditions around the Korean Peninsula.”

Since President Lee Myung-bak took office this year, exchanges between the two Koreas have been rare. Still, aid to the light-water reactor and the Gaesong industrial complex projects and civilian donations have continued, amounting to a combined 211.3 billion won. (Donga Ilbo)

It appears the Russians are doing their part to bring the North and South together through a project they can all agree on—building a natural gas pipeline from Russia to South Korea via the DPRK:

South Korea plans to import $90 billion of natural gas from Russia via North Korea, with which it shares one of the world’s most heavily fortified borders, to reduce its reliance on more expensive cargoes arriving by sea.

State-run Korea Gas Corp. signed a preliminary agreement with OAO Gazprom, Russia’s largest energy company, to import 10 billion cubic meters of natural gas over 30 years starting in 2015, the Ministry of Knowledge Economy said in a statement. The accord was signed in Moscow during President Lee Myung Bak’s three-day visit that began yesterday.

Gazprom Chief Executive Officer Alexei Miller said after talks today between Lee and Russian President Dmitry Medvedev that the exact delivery route hasn’t been determined and that shipments could begin as early as 2015.

“Russia suggested a pipeline via North Korea, which is expected to be more economical than other possible routes,” the minister said in a news briefing. “Russia will contact the North to discuss this.”

“Transporting gas through North Korea could be risky for South Korea,” said Kim Jin Woo, a senior research analyst at Korea Energy Economics Institute. “But the project will ease tensions on the Korean peninsula if Russia successfully persuades North Korea” to accept the plan.

North Korea could earn $100 million a year from the gas- pipeline project, the Ministry of Knowledge Economy said.

“Russia will supply the fuel in the form of LNG or compressed natural gas if negotiations with North Korea do not work out,” according to the ministry’s statement. South Korea and Russia will sign a final agreement in 2010 when a study on the route is completed.

South Korea is turning to Russia, holder of the world’s biggest proven gas reserves, as it faces intensifying competition for energy resources from China and Japan. Asia’s fourth-largest economy depends on gas for 16 percent of its power generation.

Under the agreement, a pipeline to South Korea will be laid via North Korea from gas fields on Sakhalin Island in Russia’s Far East. The pipeline would initially carry 10 billion cubic meters of gas a year, or about 20 percent of South Korea’s annual consumption. The cost of the gas link’s construction is estimated at $3 billion, the ministry said.

Read the full articles here:

South Korea Seeks $90 Billion of Russian Natural Gas

Bloomberg

Shinhye Kang

9/29/2008

Liberal Gov`ts Gave W8.38 Bln to North Korea`

Donga Ilbo

9/30/2008

Posted in Agriculture statistics, Energy, Finance, Fiscal & monetary policy, Foreign aid statistics, International Aid, International trade, Japan, Mt. Kumgang Tourist Special Zone, Natural Gas, Nuclear, RoK Ministry of Unification, Russia, South Korea, Special Economic Zones (Established before 2013), Statistics, USA | 1 Comment »

Tuesday, September 23rd, 2008

Institute for Far Eastern Studies (IFES)

NK Brief No. 08-9-23-1

9/23/2008

North Korea’s Chosun International Development Trust Company, founded less than four years ago, is quickly emerging as the center for all of North Korea’s overseas business transactions. This was made public in an article published in the September 18 edition of the Chosun Sinbo, the newspaper of the Jochongryeon, an organization representing the North Korean diaspora in Japan.

The newspaper introduced the trust as being involved in “business and trade dealings with other countries, investment trust activities, financial services and other activities,” while “raising the credit rating of related domestic enterprises through solid business practices and broadly and continuously expanding business transactions with foreign enterprises.” This trust was founded in April 2004, and handles import-export business and investment trust services, as well as financial services and other activities for foreign enterprises. The main imports of the trust are soybean oil and other foodstuffs, fertilizer, and farm-use products such as vinyl sheeting, which are high on the list of consumer demands within North Korea. The trust has set up an exchange market in the Botong River area of Pyongyang, and is responsible for providing production materials to the North’s businesses and farming towns.

This business also focuses on trust investment and financial services. According to the Chosun Sinbo, the trust is “solidifying economic utility and connecting domestic and international firms that are promoting positive prospective plans, guaranteeing and investing capital necessary for the development of national businesses.” The paper also explained that the trust “also provides financial services, actively promoting the management of domestic enterprises.” According to the article, it appears that the Chosun International Investment Trust Company is receiving foreign capital and investing it in North Korea’s domestic businesses.

The trust seeks capital, particularly Chinese capital in Beijing and Jilin, and invests this foreign capital in the building and operating of a leaf tobacco processing plant, a hygienic products production plant, food processing facilities, automobile repair facilities, and other joint venture and cooperative venture projects.

Posted in Agriculture, Banking, Chosun International Development Trust Company, Economic reform, Finance, Fiscal & monetary policy, Foreign direct investment, Institute for Far Eastern Studies, Joint Ventures | Comments Closed