China’s economic slowdown and a plunge in coal prices are depriving North Korea of critical foreign currency, threatening to stir discontent among the small, elite class that the nation’s mercurial dictator relies on for support.

The drain on income comes as North Korea continues to plow its limited resources into its armed forces. On Saturday, the isolated state is set to hold a military parade to mark the 70th anniversary of the founding of its ruling party. It has also declared plans to launch satellites, seen by the U.S. and others as a way to test ballistic missile technology.

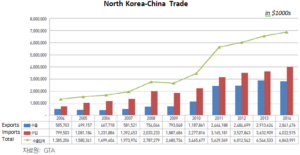

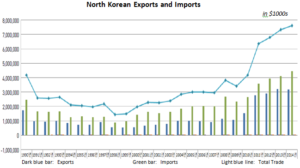

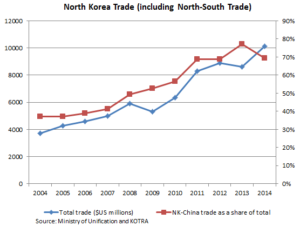

The value of North Korean exports to China, by far Pyongyang’s biggest trade partner, fell 9.8% through August from the year-earlier period, Chinese data show, accelerating from a 2.4% decline last year.

Adding to the pressure on Pyongyang is China’s attempt to scale back its bloated steel industry, the main customer for North Korea’s biggest export product, coal.

The scenario leaves North Korea’s young leader, Kim Jong Un, vulnerable. North Korea depends on China to buy most of its exports, but ties between the longtime allies have become strained over North Korea’s nuclear brinkmanship. To boost exports, Pyongyang has little option but to turn to its only other significant trade partner, South Korea.

All of this means Mr. Kim has less foreign currency to underwrite the lifestyles of the North Korean elite whose support is essential to maintaining his grip on power.

“Raising living standards for the North Korean apparatchik class is extraordinarily dependent on trade with China in a single commodity,” said Marcus Noland, executive vice president of the Peterson Institute for International Economics, a Washington research group. “A slowdown in revenues will create discontent.”

The depth of possible repercussions is hard to gauge because of North Korea’s opaque economy and political system. There are no clear outward signs of government instability, and prices of daily necessities such as rice—often an indicator of economic shocks—remain steady, said Nicholas Eberstadt, a political economist at the American Enterprise Institute, a Washington think tank.

North Korea continues to press ahead with infrastructure projects, such as the recent opening of a new international airport terminal near Pyongyang. The emergence of semiprivate businesses such as taxi companies in recent years has provided the state with fresh sources of income, said Go Myung-hyun, an expert on North Korea at the Asan Institute for Policy Studies, a Seoul-based think tank.

And China’s ban starting this year on highly polluting types of coal somewhat shields North Korea’s coal exports from a fall in demand because they are mostly high-quality anthracite, a type that produces little smoke.

Still, the fall in trade revenue increases the challenge for Mr. Kim, who has said economic development is a top policy priority despite his reluctance to embrace Chinese-style economic reforms, such as privatizing state businesses. In 2012, Mr. Kim said in a speech that citizens should “not have to tighten their belts again,” and North Korea’s state media frequently tout the construction of apartment buildings and leisure facilities as examples of progress.

Andrei Lankov, a professor at Kookmin University in Seoul, says the regime has been trying to reduce its dependence on China, which now absorbs as much as 90% of Pyongyang’s exports, compared with around 50% in the early 2000s, according to the Korean International Trade Association in Seoul. The value of those exports last year was $2.9 billion, Chinese customs data show.

One sign of that concern came in late 2013 when Mr. Kim executed his own uncle, Jang Song Thaek, an official who was widely seen as a proponent of closer trade links with Beijing. State media blamed Mr. Jang for “selling off precious resources of the country at cheap prices.”

Pyongyang’s diplomats have traveled extensively around the world over the past year, including a rare foreign ministry visit to India in April. Still, many nations remain wary of boosting trade links as North Korea continues a nuclear standoff with the U.S. and other nations.

Last year, North Korea and Russia signed an ambitious economic development agreement, but while Pyongyang and Moscow have warmed politically—reflecting shared hostility toward the U.S.—few economists see much potential for significant growth in bilateral trade; North Korea’s exports to Russia totaling just $10 million in 2014.

U.S. and South Korean diplomats say that greater international scrutiny has crimped another North Korean revenue stream: illicit arms and drugs.

Many economists say South Korea is the North’s only near-term option to offset declining trade income from China and may have motivated Pyongyang in August to reach an accord to end a confrontation after the two sides exchanged artillery fire.

“South Korea is the one potentially interested partner that could provide a significant boost to North Korea’s economy,” said Troy Stangarone, senior director for congressional affairs and trade at the Korea Economic Institute in Washington.

The South imposed economic sanctions on the North in 2010, blocking most bilateral trade, in response to the sinking of a warship that killed 46 sailors. Trade has since edged up and Seoul says it is willing to discuss increasing economic cooperation if progress is made in other areas, such as reuniting families separated by the Korean War.

Lee Jong-kyu, a research fellow at the Korea Development Institute in Sejong, South Korea, said the North may also seek new revenue by ramping up its exports of manual laborers to places such as Russia and the Middle East, try to boost tourism or build up light industry. North Korea also has tried to reboot plans for foreign investment in special economic zones—with little success, say foreign officials.

Ultimately, while Chinese diplomats express frustration with the regime in North Korea, it is unlikely that Beijing would allow its volatile neighbor to become destabilized by a fall in trade and spark a humanitarian disaster on its doorstep, observers say.

“If Beijing is a generous uncle, this will not prove to be a perilous problem because uncle will send more allowance,” Mr. Eberstadt said.