Institute for Far Eastern studies (IFES)

2012-2-7

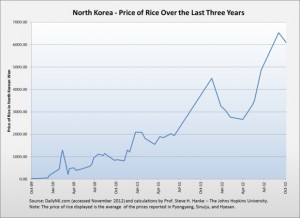

A year has passed since Kim Jong Un took power, yet that has not prevented instability to continue in the price of rice and foreign exchange rates in North Korea, having doubled in some cases compared to last year.

According to “North Korean Market Trends,” published by the online newspaper Daily NK, the price of rice per kg from January 2 to 9, 2013 in Pyongyang, Sinuiju, and Haesan was 6,700 KPW, 7,000 KPW, and 6,600 KPW, respectively. This was a rise of 300 KPW, 200 KPW, and 100 KPW in just two weeks.

During the same period, the foreign exchange rates in Pyongyang, Sinuiju, and Haesan also escalated to 9,100 KPW, 8,950KPW, and 8,750 KPW, a rise of 1,300 KPW, 950KPW, and 300 KPW, respectively.

This is the highest recorded price for rice and exchange rates. Last year from January 15 to 21, the price of rice in Pyongyang was 3,200 KPW and the exchange rate was 4,400 KPW. Compared to current prices, the price has more than doubled.

Prices began to escalate drastically from April 2012. Recorded highs were recorded from September 24 to 27 (at 6,800 KPW). Since then they have continued to remain high.

The Daily NK interpreted the increase in rice prices and exchange rates to be consequential of the political events that resulted in a decrease in food transactions and North Korean residents’ preference for US dollars.

Instability in rice prices and exchange rates are expected to continue as the international community adopted a new resolution to impose sanctions against North Korea in response to North Korea’s “long-range rocket launch” (December 2012) and recent announcement that it is preparing to conduct another nuclear test.

*(NKeconWatch) Another cause of the price increases is inflationary public finance in the DPRK.