By Benjamin Katzeff Silberstein

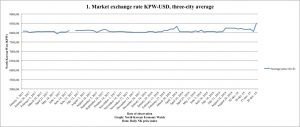

Judging by the latest market price data from Daily NK, the exchange rate of the North Korean won (KPW) to the US dollar (USD) appears to have reached its highest point since the beginning of the latest period of heightened tensions with the United States. The latest price observation by the Daily NK puts the KPW-USD average exchange rate on markets in three North Korean cities at 8,500 won. That’s an increase of 445 won from the last observation (December 11th), or about 5 percent in a fairly short time span. (Please click both graphs for closer views).

Graph 1. KPW-USD average exchange rate for markets in three North Korean cities, January 2017–December 2018. Data source: Daily NK.

The Chinese Renminbi (RMB) has also appreciated against the won in the latest observation, but not by as much. From the observation on December 11th, the RMB went up from 1197 KPW to 1242, an increase by about 3.7 percent.

Graph 2. KPW-RMB average exchange rate for markets in three North Korean cities, January 2017–December 2018. Data source: Daily NK.

As graph 2 shows, the RMB-increase is almost as large as the one for USD. The RMB, however, is not at an historical high for the period in question, which the USD is. The RMB is, on the other hand, significantly higher than in the same period last year, and from December 26th of 2017, it’s increased by almost 11 percent, from 1120 KPW to 1241. The USD, meanwhile, stands at about 6 percent more than it did on December 26th of 2017.

In other words, both currencies have appreciated, and by significant proportions, assuming that this latest price report conveys accurate information representatives of the general exchange rate level in the country. It doesn’t seem to be a seasonal issue, given the differences from last year.

With the information currently available, it is of course very difficult to tell what could have caused this minor spike of sorts. The two currencies are likely not controlled by the exact same factors, as the RMB is much more widely used among the North Korean public. Few people hold and use USD on a daily basis. Rather, the main holders of USD in North Korea are likely to be state institutions such as major state-owned enterprises. This matters for the way the markets are likely to work for RMB and USD respectively.

Both, on the other hand, are foreign currency. As such, they are at least partially interchangeable. To put it simply, if the regime would decide to soak up foreign currency in general, for whatever purpose, it would likely target both USD and RMB, and other foreign currencies as well, because they can be used for the same things to a large extent.

So. What could (and I say could with the utmost of caution) have caused this upturn?

The regime has been conducting market crackdowns on illegal trade and smuggling of banned foreign goods, such as foreign media, over the past few months. An upturn in this crackdown could cause anxiety on the markets, causing people to hoard foreign currency. It doesn’t seem, however, that foreign currency trade has been targeted in particular, making this scenario unlikely.

It could also be that other goods that require foreign currency payments, such as gasoline, have become more expensive. This means that traders buying and selling such goods need more foreign currency to pay for their imports, and they may even require foreign currency payments from their customers. This, in turn, would cause the RMB and possibly the USD to appreciate over the KPW. But gas prices aren’t out of their ordinary span, and they’ve actually decreased in the latest price observation, to 15,200 won/kg from 15,200 won/kg, albeit after first spiking from 13,133 won/kg to 15,733 won/kg between mid- and late-November. Still, the trends don’t run in parallel.

A third possibility, and the most likely one out of the three presented here, in my opinion, is that the state has soaked up foreign currency from the markets by, for example, demanding more of it from state-owned enterprises. It could also be that if in normal times – and this is a big if – the state releases foreign currency on to the markets to maintain exchange rate stability, they’re doing less of that now, causing the foreign exchange rate to appreciate. The state’s foreign currency reserves and coffers have likely been dwindling for some time under sanctions. Curiously, we haven’t seen signs of it on the markets. It will be interesting to see whether the trend continues in the weeks and months ahead.

Tags: 2018 sanctions