By Benjamin Katzeff Silberstein

The Bank of Korea has released its yearly estimate of North Korea’s economic trends for last year. The estimate gives a contraction of the economy by 4.1 percent. Reuters/Channel News Asia:

North Korea’s economy shrank in 2018 for a second straight year, and by the most in 21 years, hit by international sanctions to stop its nuclear programme and by severe drought, South Korea’s central bank said on Friday (Jul 26).

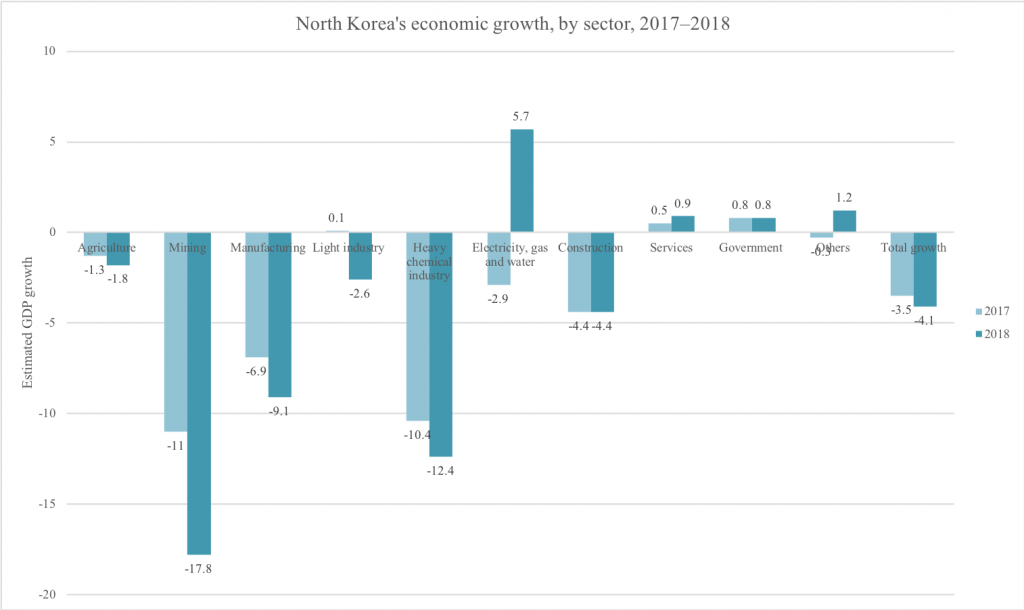

North Korea’s gross domestic product (GDP) contracted by 4.1 per cent last year in real terms, the worst since 1997 and the second consecutive year of decline after a 3.5 per cent fall in 2017, the South’s Bank of Korea estimated.

North Korea does not disclose any statistics on its economy. The South Korean central bank has been publishing its estimates since 1991, based on information from various sources including the South’s foreign trading agencies.

North Korea’s international trade fell 48.4 per cent in value in 2018 as tougher international sanctions in late 2016 and 2017 cut exports by nearly 90 per cent, the Bank of Korea said.

Output in the mining sector shrank 17.8 per cent because of sanctions on exports of coal and minerals, while the agriculture, forestry and fisheries sector contracted by 1.8 per cent because of drought, it said.

North Korea’s population was estimated at 25.13 million and annual income per head at S$1,298, the South Korean central bank said.

Article source:

North Korea’s economy shrinks most in 21 years in 2018: South Korea

Reuters/Channel News Asia

2019-07-26

I won’t go into much depth on the methodological issues with all this, but suffice to say that because Bank of Korea doesn’t release much information on their models, estimates, assumptions and the like, their analysis is always difficult to evaluate. That’s why it’s not particularly helpful to state that it’s the lowest growth (or largest contraction) since 1997. That may be true, but proportions aren’t necessarily all that relevant or accurate here.

That said, broadly, the estimate makes sense. In fact, it may be a slight lowball estimate. South Korean economist Kim Byung-yeon put estimated a 5-percent contraction for 2017, which sounds more reasonable to me.

The BoK estimate of the mining sector is particularly interesting. They give a contraction of 17.8 percent of the sector as a whole for 2018, after claiming in 2017 that it shrank by 11 percent. On the one hand, it’s interesting to think about how all this might look domestically. This would mean that around 70 percent of the mining sector which operated in 2016, continues to operate today. So what’s happening with all that coal, and all those minerals? Well, we get a hint of that in the estimates for electricity generation and water. This was down by -2.9 percent in the estimate for 2017.

Now, the estimate instead gives an increase of 5.7 percent. This positive effect for domestic electricity generation has been anecdotally reported by outlets such as Daily NK for quite a while. Cheaper electricity has made supply much better in parts of the country. This is a relatively minor positive, as the revenue loss from decreased exports is much greater. Nonetheless, there may be a slight impact here of cheaper electricity cushioning some of the lower demand for industrially manufactured goods.

Here’s a graph comparing the 2017-2018 estimates, based on the BoK data (which you can find here).

Bank of Korea estimates of North Korean GDP growth, by sector, 2017 and 2018. Graph by NK Econ Watch.

It’s also important to bear in mind that the baseline here was fairly high. North Korea has experienced a few years of solid economic trends, so a negative growth of four percent isn’t necessarily catastrophic. Of course, it’s very bad, but there are more nuances to these things than full stability or complete disaster.

Tags: 2018 sanctions